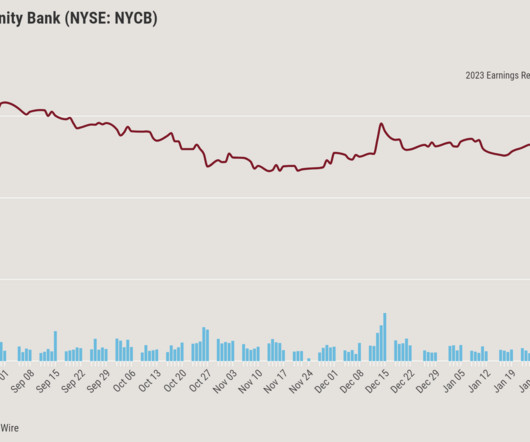

DataDigest: Office debt is stressing banks. That matters for mortgages.

Housing Wire

FEBRUARY 14, 2024

The rapid collapse of four regional banks that began last March shocked regulators and investors alike. The banks had courted high-net-worth clients working in speculative tech and crypto startups in Silicon Valley, while also tying up a large portion of the banks’ assets in Treasury securities. By the end of Feb.

Let's personalize your content