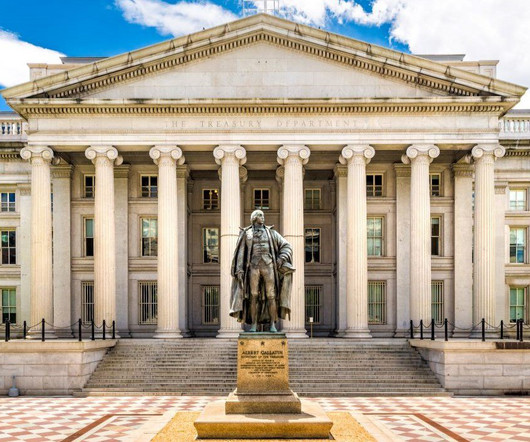

Opinion: Bank capital requirements would put squeeze on mortgage market

Housing Wire

NOVEMBER 7, 2023

In September, the nation’s banking regulators released a proposal to increase the capital required of banks with more than $100 billion in assets. The effort was intended to decrease systemic risk, but by focusing narrowly on the risk posed by banks, it would likely increase risk in the mortgage market.

Let's personalize your content