MORE Seller Financing wants to debunk ‘the bad rap for wraps’

Housing Wire

MAY 15, 2025

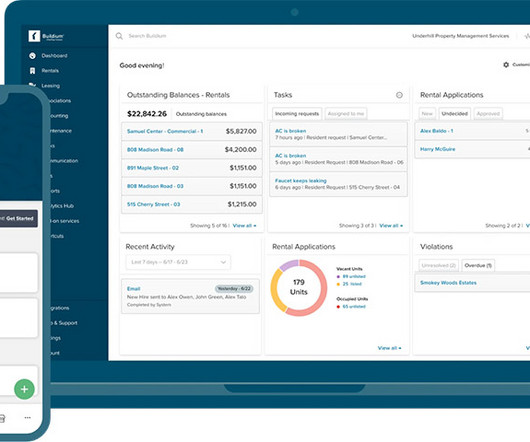

In an era of high mortgage rates and stagnant home sales , a real estate transaction model is making waves by reintroducing and standardizing a once-popular financing method. We are the very first company in the country to standardize the seller financing process, put a wrapper around it, brand it and call it MORE, Leahy told HousingWire.

Let's personalize your content