Banks report tightened lending standards for nearly all residential mortgages: Fed survey

Housing Wire

FEBRUARY 6, 2024

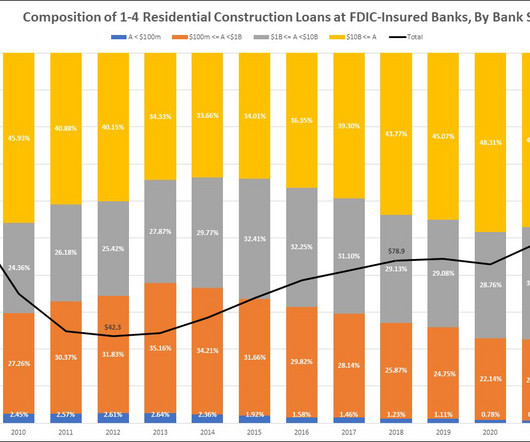

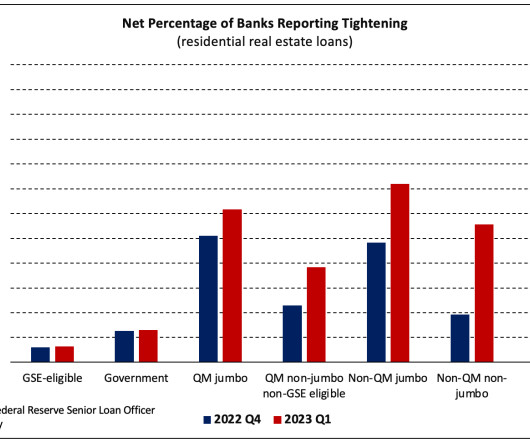

Banks reported having tightened lending standards across almost all categories of residential real estate loans over the fourth quarter of 2023 amid an elevated interest rate environment. of banks reported weaker demand for HELOCs. There’s some optimism, however. A 50%-plus net share of all U.S.

Let's personalize your content