As mortgage rates near 8%, loan originators target first-time homebuyers

Housing Wire

OCTOBER 4, 2023

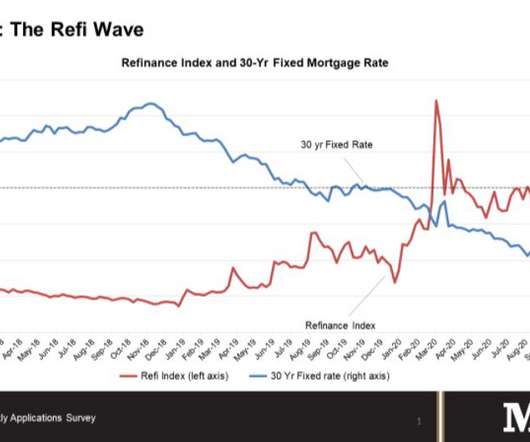

In an environment where 30-year fixed mortgage rates are racing towards 8%, loan officer pipelines are thinning dramatically. But LOs who cater to first-time homebuyers’ needs – offering FHA loans and down payment assistance loans — are faring better, Michael Ullmann, producing branch leader at Movement Mortgage , explained.

Let's personalize your content