What happens after the Fed’s rate hike?

Housing Wire

OCTOBER 31, 2022

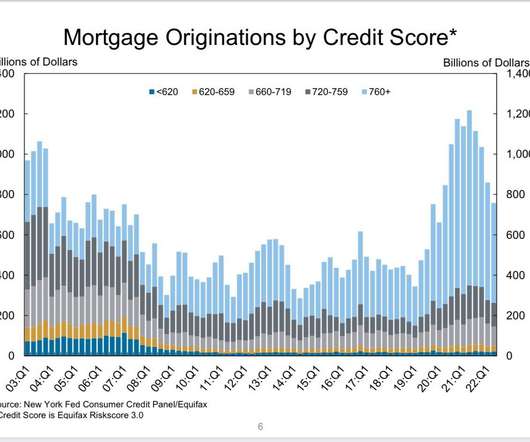

One of the unsung heroes of the most prolonged economic and job expansion ever recorded in history was the passing of the 2005 Bankruptcy Reform Act and the 2010 qualified mortgage rule under Dodd-Frank. Both these laws paved the way for more responsible lending and a more responsible consumer. Today, we are at 1.25

Let's personalize your content