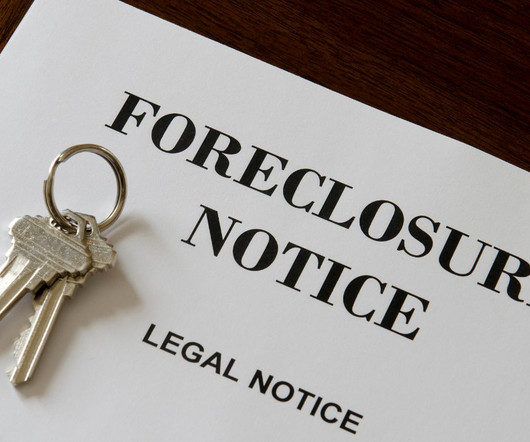

MORE Seller Financing wants to debunk ‘the bad rap for wraps’

Housing Wire

MAY 15, 2025

MORE’s model offers a short-term bridge loan typically around three years in length that’s designed to give buyers time to refinance or secure permanent financing. Ive helped a lot of divorcees who have terrible credit and people that are a few months out of bankruptcy get into a home. They just had life happen.

Let's personalize your content