Foreclosure auction volume rises 19% after VA moratorium expires

Housing Wire

JULY 21, 2025

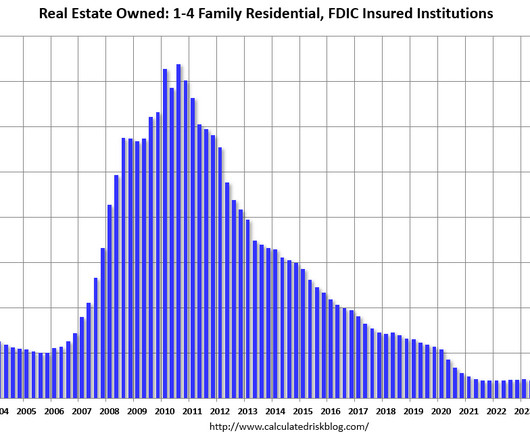

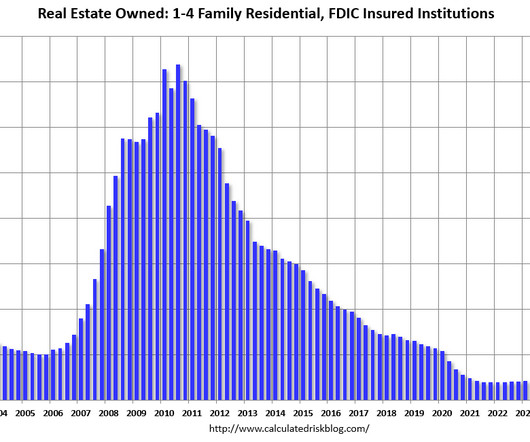

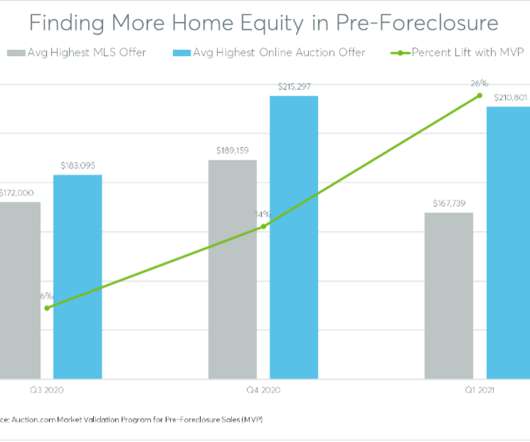

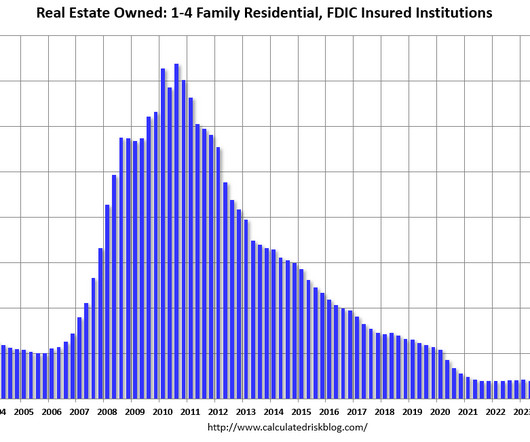

The rise in foreclosures has led to more properties ending up in real estate-owned ( REO ) auctions, especially as fewer are being bought by third-party buyers. Now I have properties that are sitting with over two years on market. Existing homes have crashed. The cooling demand is already reshaping the market.

Let's personalize your content