As a ‘higher-for-longer’ rate scenario unfolds, how is the mortgage industry adapting?

Housing Wire

APRIL 15, 2024

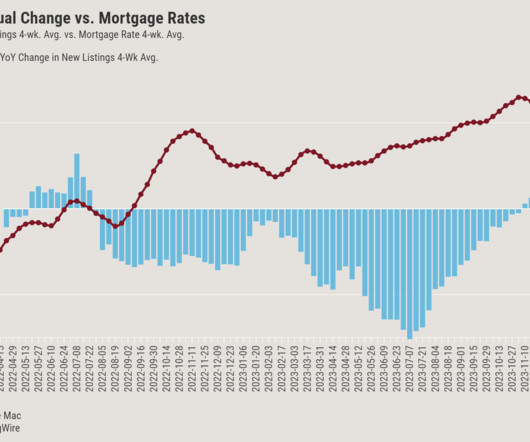

Last week’s above-consensus inflation figures brought the mortgage market back to a sour reality: The average 30-year fixed mortgage rate, an index closely watched by industry experts, may be close to or even above the 7% level for longer than previously expected. Where are mortgage rates headed? in second-quarter 2024.

Let's personalize your content