Mortgage rates fall as markets calm down

Housing Wire

APRIL 14, 2025

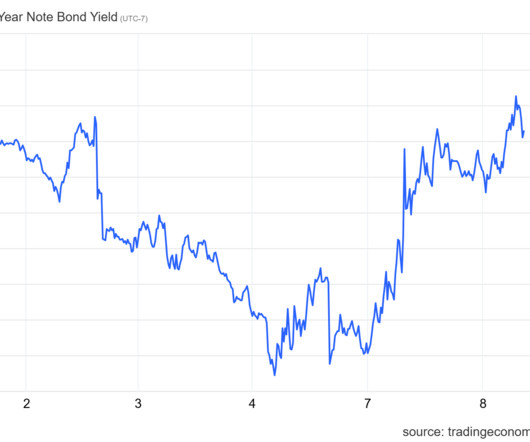

Over the weekend, fears rose that the 10-year yield would climb to 5%, leading to 8% mortgage rates. Remarkably, mortgage rates have dipped below 7% once more. So what happened to calm the markets? This situation led to a significant influx of capital into the bond market.

Let's personalize your content