Private equity and insurance companies piling into residential mortgages

Housing Wire

MAY 21, 2024

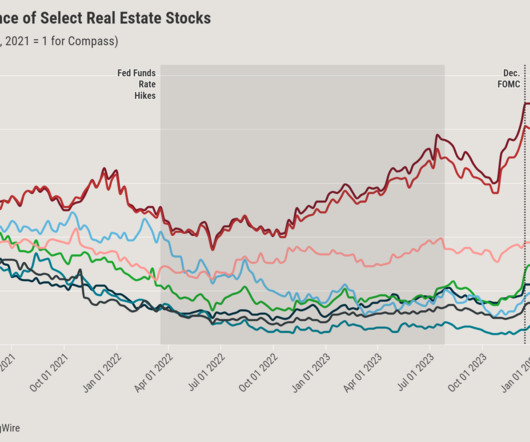

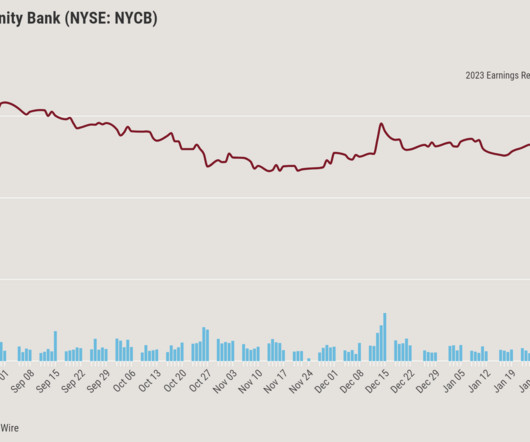

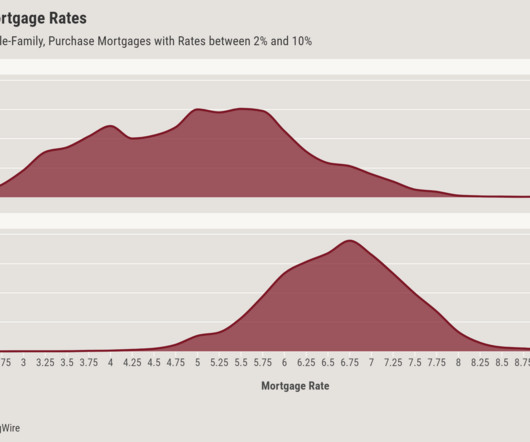

After two years of limited demand, private equity and insurance companies are increasing their allocations to single family residential mortgages. These strong fund flows are resulting in tighter credit spreads, higher prices, and an increased focus on sourcing new originations.

Let's personalize your content