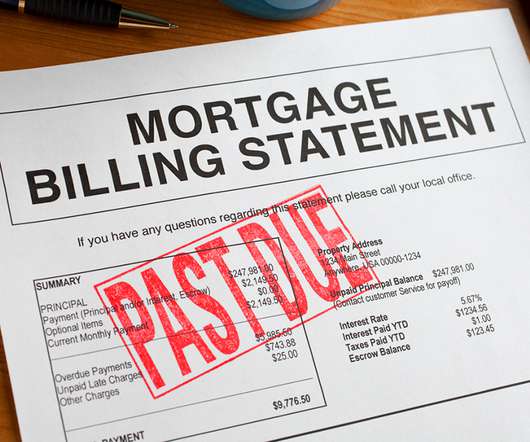

BofA’s mortgage production falls in Q1

Housing Wire

APRIL 16, 2024

Bank of America (BofA) reported another quarterly decline in mortgage and home equity production in the first quarter of 2024. mortgage lender stated it produced a volume of $3.4 billion in first mortgages from January to March, down 12.5% BofA’s mortgage assets Bank of America had $227.7 from the $3.9

Let's personalize your content