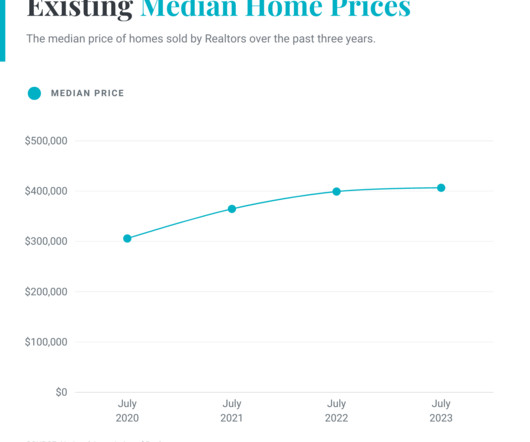

Why higher rates aren’t crashing home prices

Housing Wire

JUNE 9, 2023

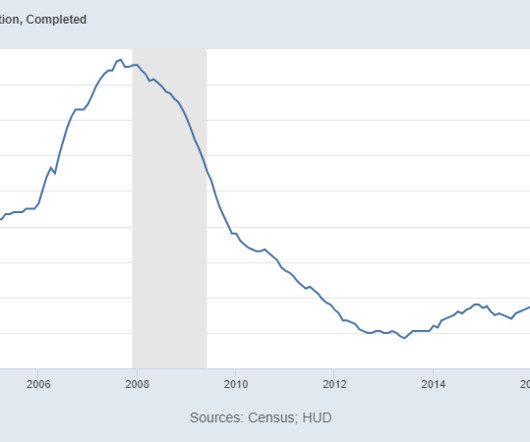

They went all in during COVID-19 in 2020, doubled down in 2021 as the forbearance crash bros but really bet the farm on a massive home-price crash in 2023 after the most significant home sales crash ever in 2022. In 2022, mortgage rates got as high as 7.37%, so the question was: how low do rates have to go for housing demand to get better?

Let's personalize your content