Mortgage rates fall after softer labor data

Housing Wire

AUGUST 4, 2023

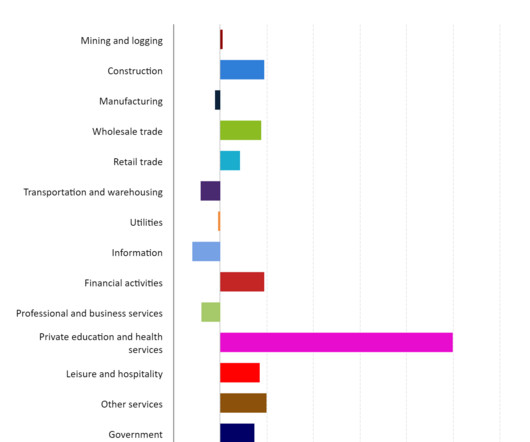

From BLS : Total nonfarm payroll employment rose by 187,000 in July, and the unemployment rate changed little at 3.5 With headline consumer price index inflation running at 3% year over year, people are seeing real wage growth again, as we have been steady at 4.4% What do I mean by a make-up demand in labor? percent, the U.S.

Let's personalize your content