From consultation to closing: The definitive homebuying checklist

Housing Wire

FEBRUARY 19, 2025

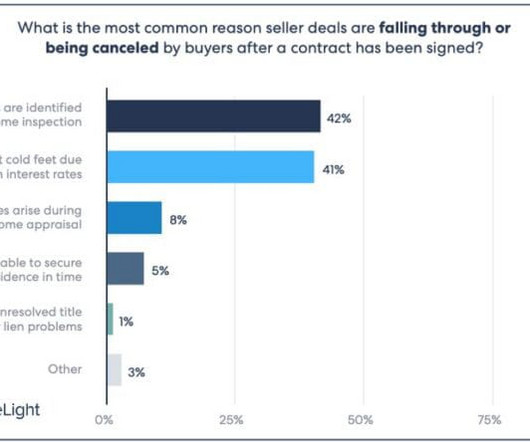

Clarify key steps like inspections, appraisals, and the importance of meeting deadlines and any impacts of missing them. Set realistic expectations: Prepare your buyers for any potential issues they may encounter during the homebuying process, such as bidding wars or appraisal gaps.

Let's personalize your content