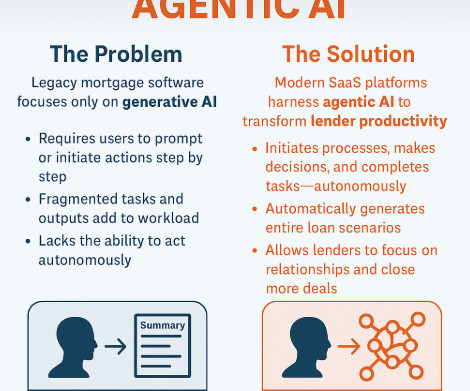

Smarter leads, lower costs: Agentic AI’s impact on loan officer efficiency

Housing Wire

MAY 9, 2025

A substantial component of this expense is attributed to Loan Officer Compensation (LO Comp), which typically constitutes 1% to 2% of the loan amount and represents nearly half of the total origination cost. Agentic AI offers a compelling solution for reducing these costs.

Let's personalize your content