Selling a House in Alabama: Expert Tips for a Faster Sale

HomeLight

APRIL 30, 2025

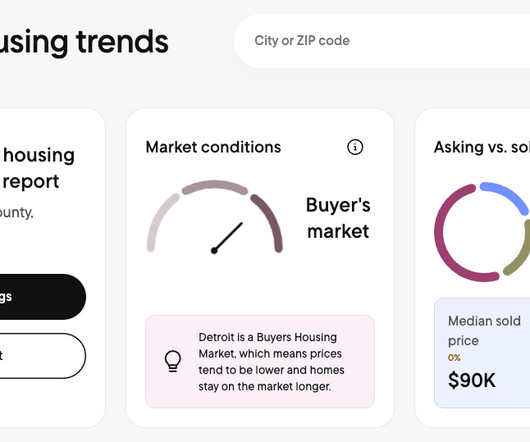

To help streamline your sale, we spoke with Jonathan Hyatt , a top-rated real estate agent serving the Birmingham area who sells homes nearly 60% quicker than average agents. Now, its closer to 61 days, according to data from the Federal Reserve Bank of St. Our data shows that the top 5% of agents in the U.S.

Let's personalize your content