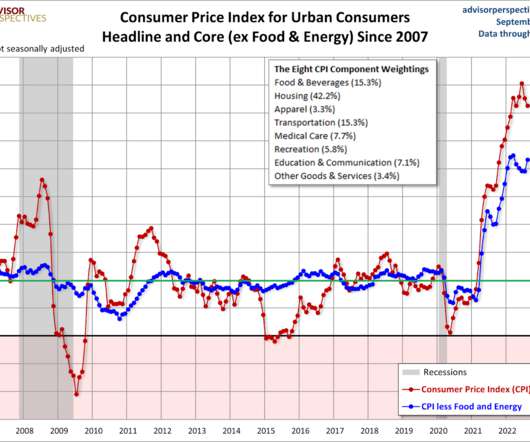

Mortgage rates decline amid expectation of economic slowdown

Housing Wire

APRIL 6, 2023

economy is slowing down. Job openings decreased to 9.9 Investors are preparing for Friday’s job report, anticipating signs of a slowing economy in light of February’s job openings and labor turnover report, which showed falling job openings,” Hannah Jones , Realtor.com ’s economic data analyst, said in a statement. “As

Let's personalize your content