Q&A: Roam’s Raunaq Singh looks to capitalize on the potential of assumable mortgages

Housing Wire

MARCH 5, 2024

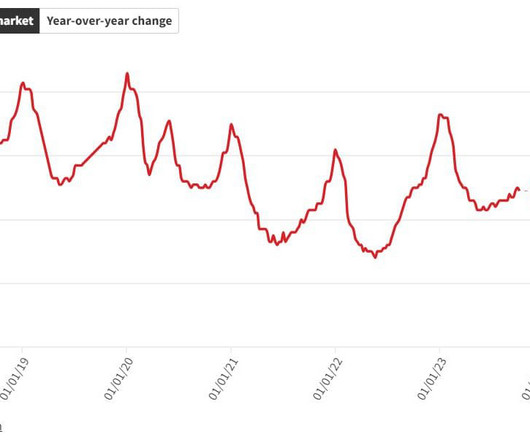

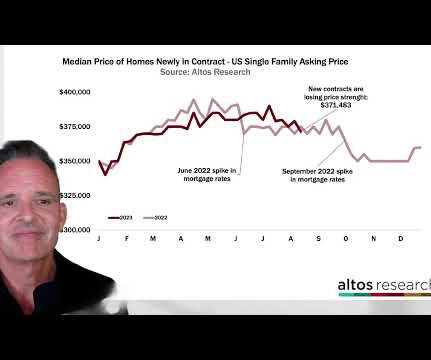

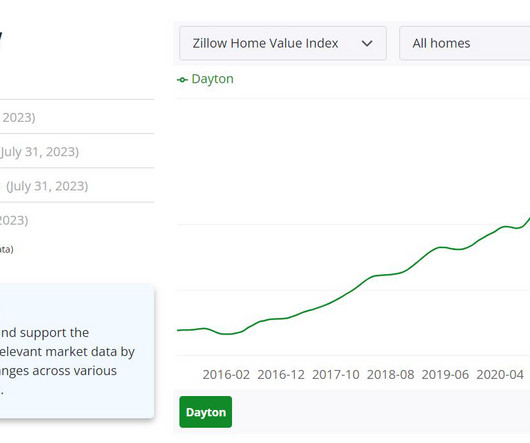

Housing affordability is at its lowest level in more than a decade, according to the National Association of Home Builders (NAHB), and there are few ways to circumvent the rising costs of housing. An assumable mortgage enables a qualified buyer to take over a seller’s mortgage terms, including the existing balance and interest rate.

Let's personalize your content