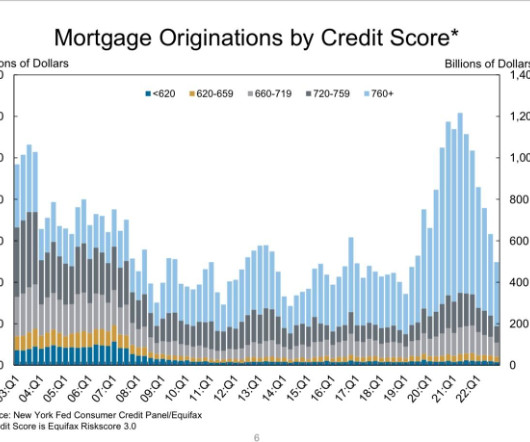

Mortgage credit availability dips as home prices surge

Housing Wire

APRIL 7, 2022

“Credit availability has gradually trended higher since mid-2021 but remains around 30% tighter than it was in early 2020.” ” While the Conventional MCAI, which does not include loans backed by the government, rose 0.3%, the Government MCAI, which examines FHA, VA, and USDA loan programs, fell by 1.6%.

Let's personalize your content