Peeking into Pennymac’s ‘aggressive’ goal to double broker market share by 2026

Housing Wire

APRIL 28, 2025

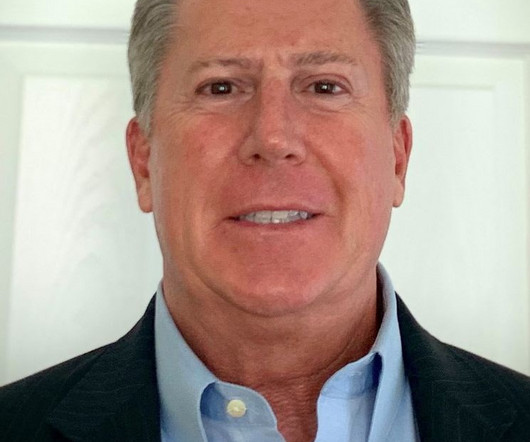

During last week’s earnings call, PennyMac Financial Services chairman and CEO David Spector said during a Q&A with investors and analysts that the company’s goals include continued growth in its broker direct channel and 10% market share by the end of 2026 a goal of more than 100% growth over the next 18 months.

Let's personalize your content