Q1 Update: Delinquencies, Foreclosures and REO

Calculated Risk Real Estate

JUNE 4, 2025

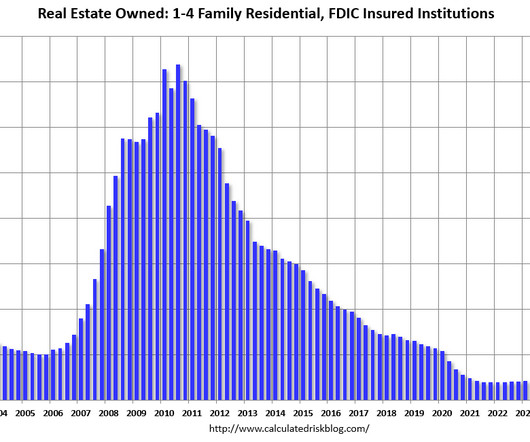

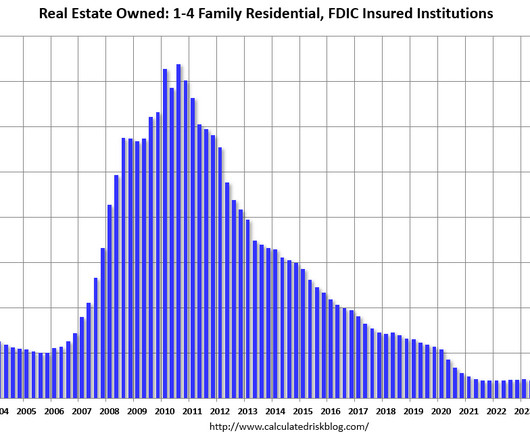

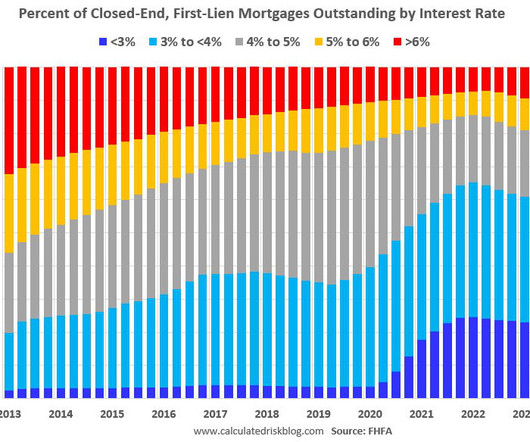

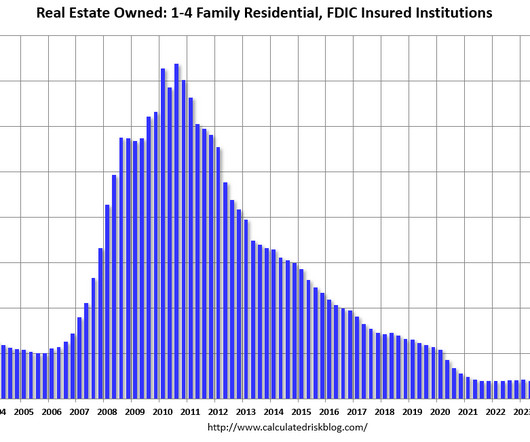

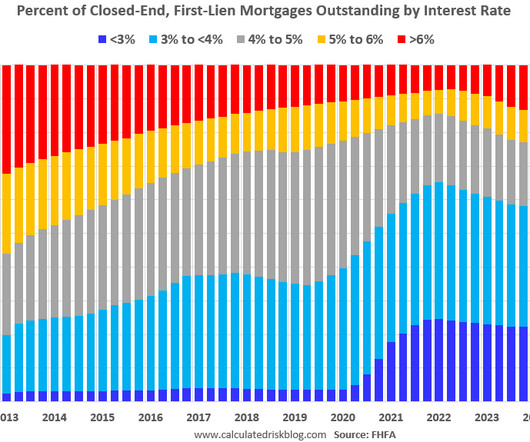

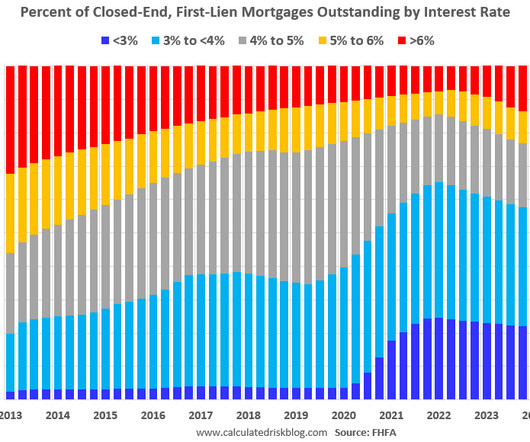

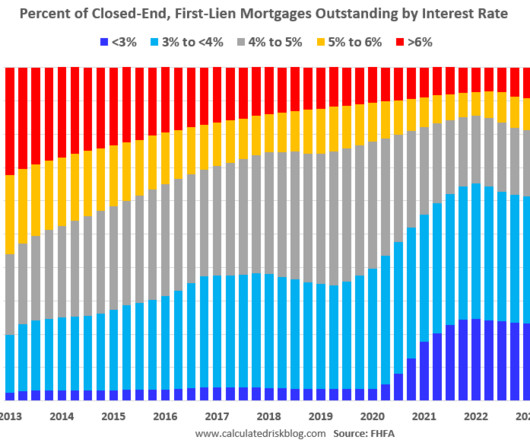

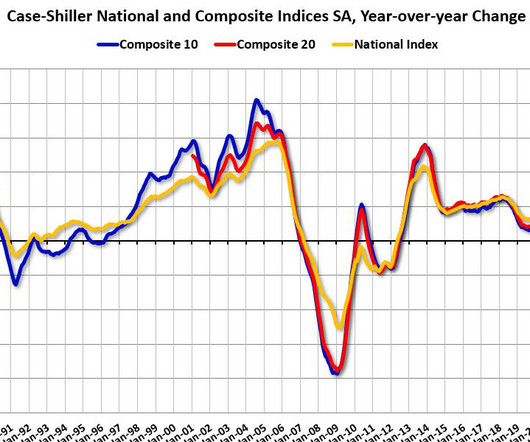

We will NOT see a surge in foreclosures that would significantly impact house prices (as happened following the housing bubble) for two key reasons: 1) mortgage lending has been solid, and 2) most homeowners have substantial equity in their homes. Here is a graph of Fannie Real Estate Owned (REO). percent in Q1 2024 to 0.49

Let's personalize your content