How non-QM loans boost mortgage originator for success in 2025

Housing Wire

FEBRUARY 6, 2025

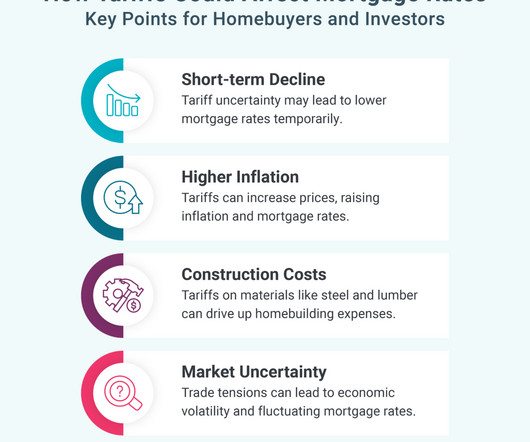

Buyers want affordable new homes, yet new construction listings are still playing catch up with their high-priced counterparts. In addition to all of these challenges, economic factors outside of housing are making it harder for potential buyers to acquire qualifying mortgage loans. Finance a loan, and you may lose money.

Let's personalize your content