Black Friday deals on a new home? Here you go

Housing Wire

NOVEMBER 15, 2024

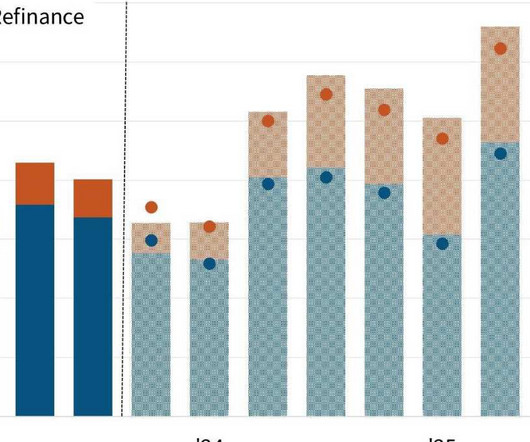

Buyers using this incentive can qualify for either a 3/2/1 rate buydown on a 30-year FHA Fixed-rate Mortgage or a 3/2/1 rate buydown on a 30-year conventional fixed-rate mortgage. Several areas, including Central Ohio, Greater Austin, Texas, and Charlotte, N.C.,

Let's personalize your content