Mortgage delinquencies edged higher in November: ICE

Housing Wire

DECEMBER 21, 2023

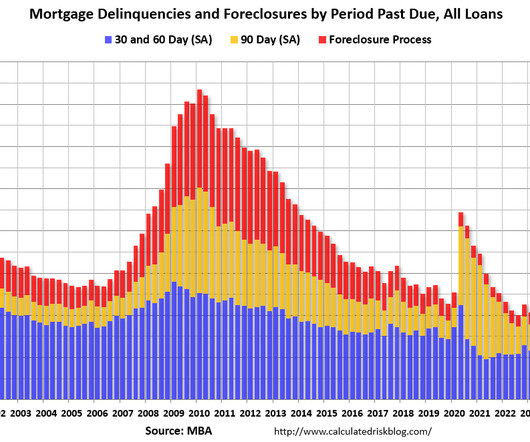

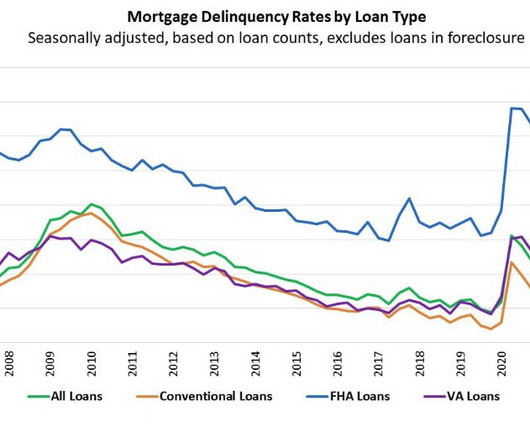

While delinquencies remain low overall, the number of delinquent loans ticked up in November, according to the latest ICE Mortgage Monitor report. Furthermore, the delinquency rate among FHA loans is at a nine-year high, and will be worth watching closely in 2024, the report said. Foreclosure starts decreased by 12.2%

Let's personalize your content