Conforming, FHA loan limits rose for 2024, but who benefits?

Housing Wire

DECEMBER 1, 2023

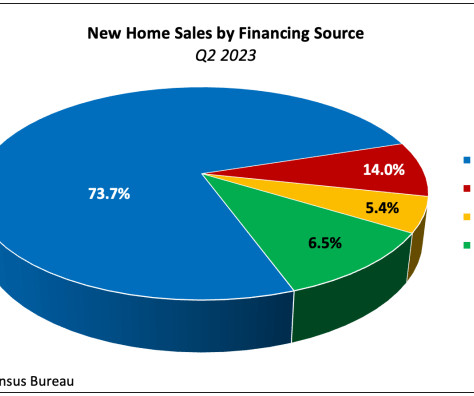

Rising home prices also prompted the Federal Housing Administration (FHA) to adjust its loan limits — with the “floor” FHA loan limit for one-unit properties increasing to $498,257 in most parts of the country. on an annual basis in 2024. next year.

Let's personalize your content