Industry experts are closely watching delinquency rates, insurance costs

Housing Wire

FEBRUARY 23, 2024

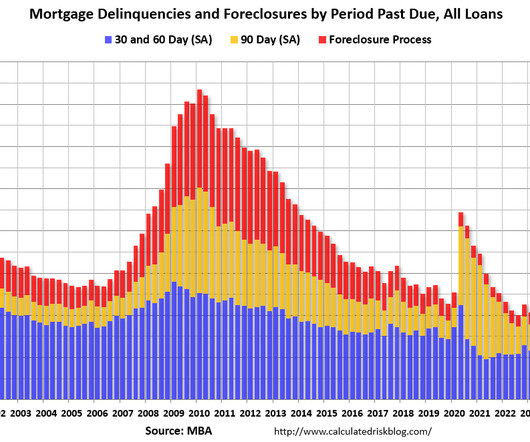

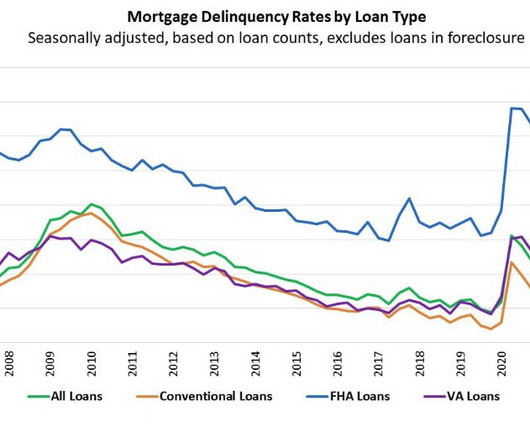

Mortgage servicers, regulators and economists are closely watching the delinquency rates for Federal Housing Administration (FHA) loans following a spike in the fourth quarter of 2023. Meanwhile, the FHA-insured loan delinquency rate recorded a larger jump during the same period to 10.81%, up from 9.5%, the highest level since Q3 2021.

Let's personalize your content