How to Buy a Multifamily Property in 10 Steps

The Close

NOVEMBER 25, 2024

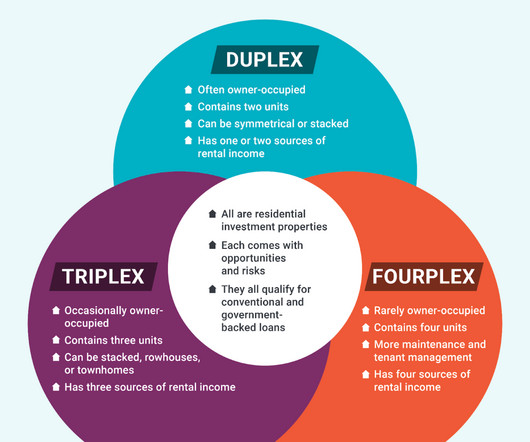

In this “How to Buy a Multifamily Property” guide, I’ll walk you through deciding which type of multifamily property you want to purchase, picking the right lender, and running the numbers to ensure profitability. What Is Multifamily Property? The higher the home’s sale price, the higher your closing costs.

Let's personalize your content