How to Invest in Real Estate: A 7-Step Beginner’s Guide

The Close

NOVEMBER 7, 2024

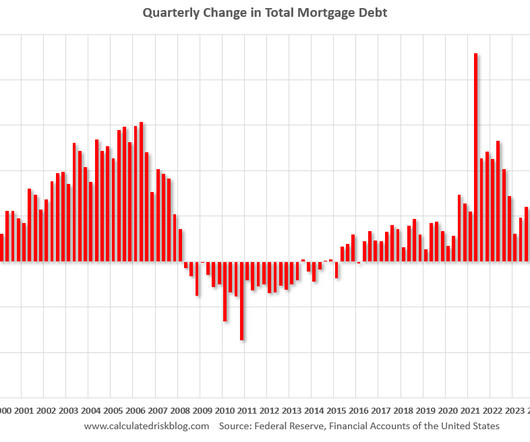

You also want to add overhead expenses like filing your business entity, advertising costs, real estate commissions and finder’s fees, taxes, and mortgage principal and interest. years on a residential investment or 39 years on commercial property, I’m subject to paying the depreciation recapture.

Let's personalize your content