The 2023 Housing Market: A Look Ahead

Housing Wire

DECEMBER 28, 2022

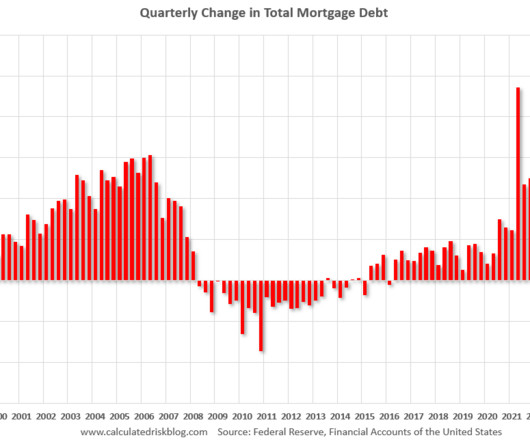

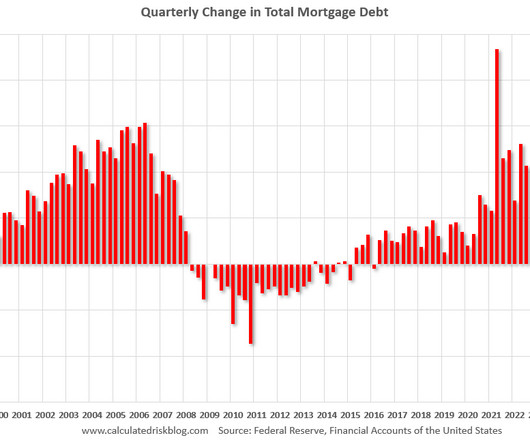

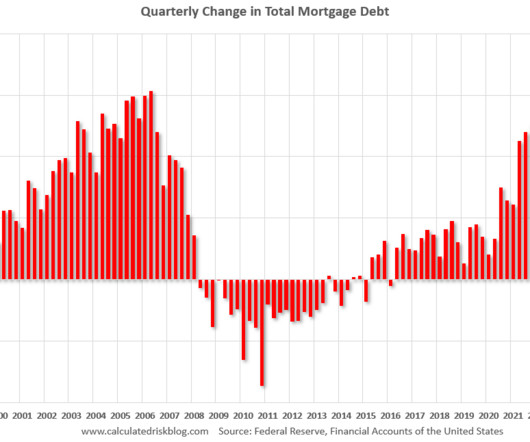

While this would be a hit to homeowner equity, only 1 to 2 percent more of homeowners would move into negative equity. First, mortgage lending standards have remained high after the last bubble. People can afford to pay their mortgages. There won’t be forced home sales like we saw in the crisis.

Let's personalize your content