Struggling homeowners often don’t understand escrow

Housing Wire

JANUARY 22, 2025

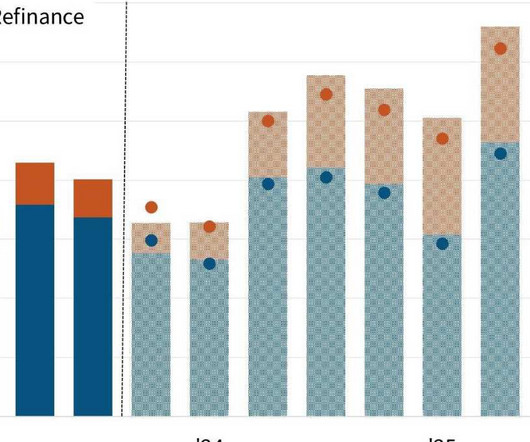

Mortgage escrow accounts are an important, yet widely misunderstood asset in the housing market. Although 80% of mortgage holders have escrow accounts, only 60% fully understand them, up from 52% in early 2024. Almost half (44%) of respondents also said they would experience hardship if their mortgage payments increased.

Let's personalize your content