High mortgage rates sideline homeowners from tapping home equity: ICE

Housing Wire

DECEMBER 3, 2023

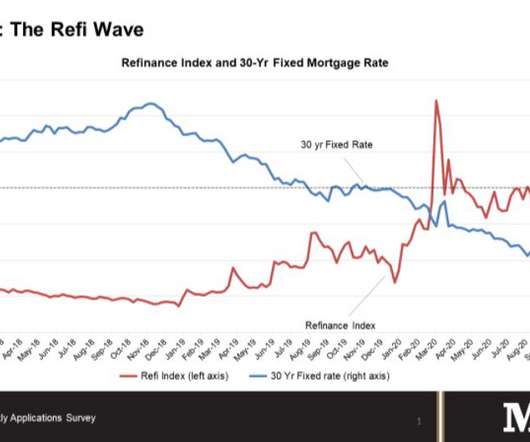

Rising home prices have pushed the third quarter’s tappable home equity amount near its 2022 peak, but interest rates are making homeowners reluctant to extract that wealth. Indeed, in recent quarters, equity withdrawal rates have been running at less than half their long-run averages. Borrowers withdrew a record $104,000 on average.

Let's personalize your content