April housing starts drop 13.4% from March

Housing Wire

MAY 18, 2021

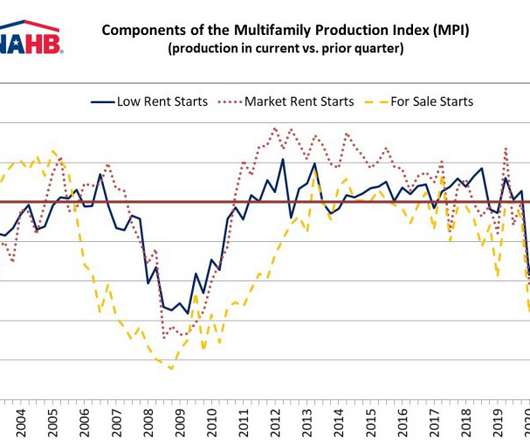

Skyrocketing prices for lumber, appliances and other building materials continue to handcuff new housing starts all over the country. Single-family housing starts in April dropped 13.4% from March to a rate of 1.09 million, according to the most recent study from the U.S. Census Bureau. Housing completions were at a rate of 1.045 million in April, just 0.1% above the March rate of 1.04 million — proof that builders are delaying housing starts due to the marked increase in costs for lumber and ot

Let's personalize your content