What post-hurricane data in North Carolina could mean for Florida’s recovery

Housing Wire

OCTOBER 23, 2024

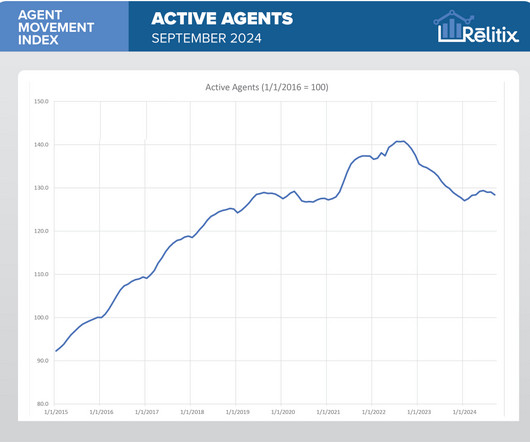

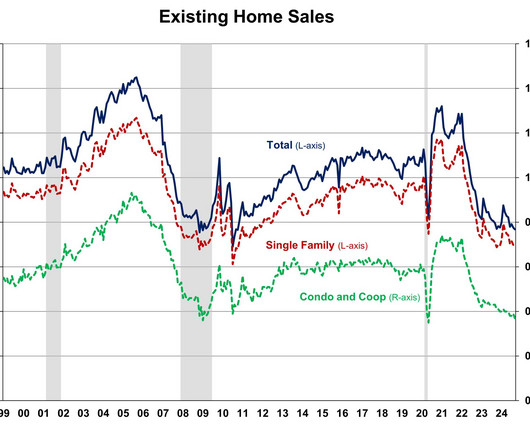

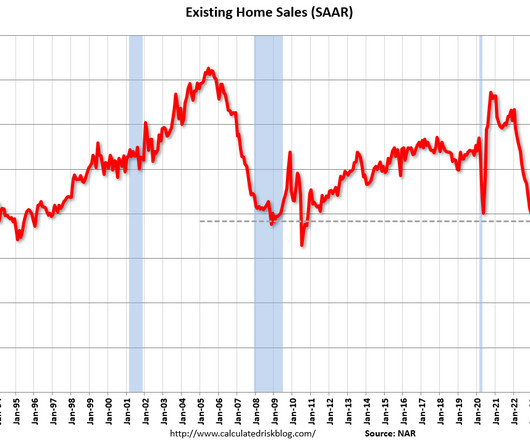

What had previously been a surprisingly mild 2024 hurricane season closed with two devastating storms that hammered Florida and North Carolina. While assessing the full scale of the damage could still take months, the short-term effects on the two state’s housing markets were immediately visible — the markets came to a complete halt. In the days right before and after Hurricane Milton battered central Florida, two highly responsive metrics went into free fall.

Let's personalize your content