When Can a Buyer Cancel a Home Purchase Agreement?

HomeLight

MARCH 7, 2024

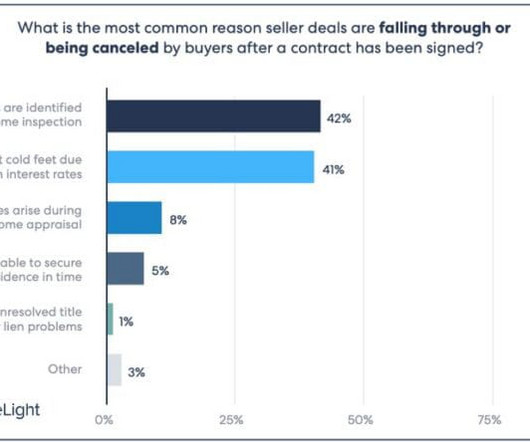

You’ve planned, juggled finances, worried about finding the right house, and then you finally sign a contract. But what happens if you’re now facing the decision of submitting a buyer cancellation of the purchase agreement? What is a home purchase agreement?

Let's personalize your content