Better Mortgage’s AI revolution: How Better is empowering loan officers, not replacing them

Housing Wire

JUNE 30, 2025

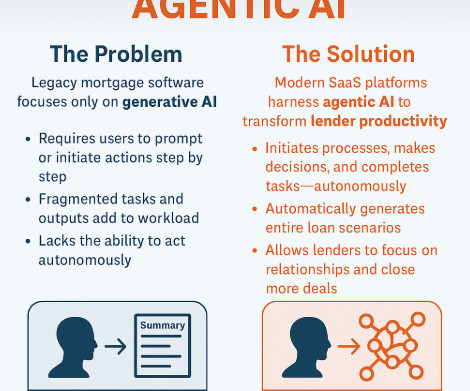

In an era where technology often threatens to overshadow human roles, Better Mortgage is charting a different course. By developing in-house AI tools designed to complement rather than replace human expertise, the company is enhancing the mortgage experience for both borrowers and loan officers.

Let's personalize your content