Retirees may be turning to home equity to finance healthcare shocks: report

Housing Wire

FEBRUARY 24, 2025

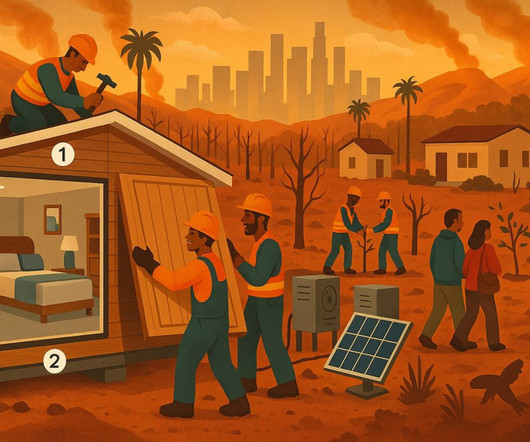

Long-term care (LTC) will likely play a large part in the lives of Americans as the population continues to age, but financing it can be a financial challenge for people particularly on a fixed income. While many retirees often do not intend to tap their home equity to finance such moves, they may often end up doing so.

Let's personalize your content