Why it’s time to rethink the appraisal default in home equity lending

Housing Wire

JUNE 23, 2025

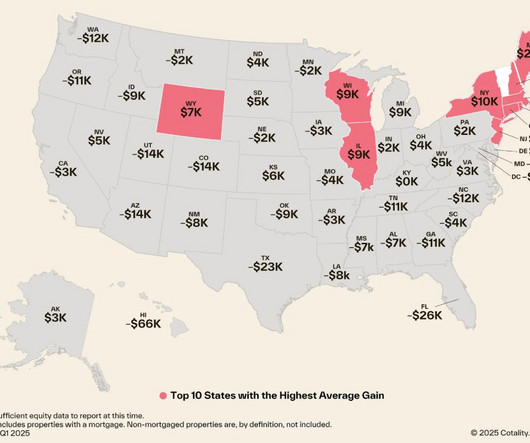

Instead of refinancing, they’re tapping into their equity through home equity loans and HELOC s to finance renovations, cover tuition, or consolidate high-interest debt. That’s well within tolerance for many second-lien lending scenarios and provides a high level of risk mitigation. Alternatives are allowed.

Let's personalize your content