CFPB issues info request for mortgage closing costs in assault on ‘junk fees‘

Housing Wire

MAY 30, 2024

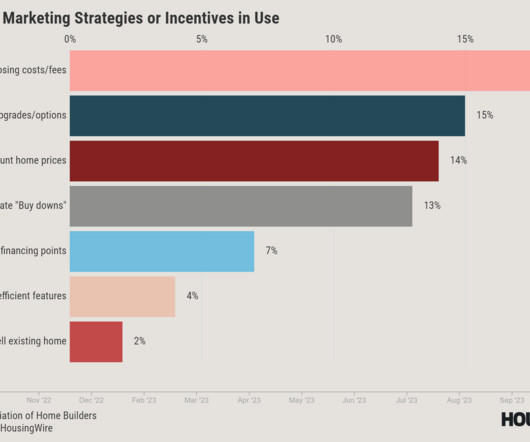

The Consumer Financial Protection Bureau (CFPB) on Thursday issued a new request for information (RFI) from the public concerning “fees charged by providers of mortgages and related settlement services,” according to the RFI document reviewed by HousingWire. Lenders are also impacted by rising closing costs.”

Let's personalize your content