Are FHA Loans Assumable? What Buyers and Sellers Should Know

Redfin

JANUARY 28, 2025

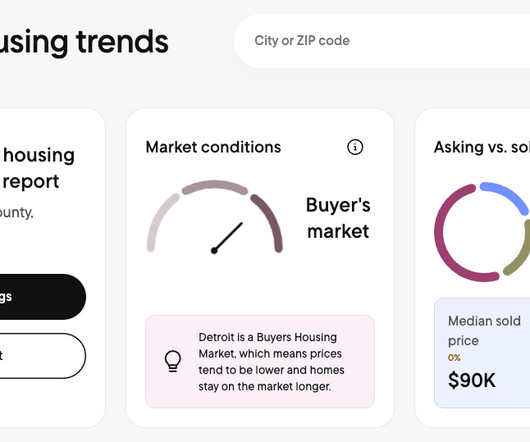

If you’re exploring mortgage options or looking to sell your home, whether its a charming home in Nashville or a spacious townhome in Houston , you might wonder: Are FHA loans assumable? Here’s how FHA assumable mortgages work and why they might be worth considering. Are FHA loans assumable?

Let's personalize your content