11 Homeselling Myths, Debunked

The Close

FEBRUARY 14, 2024

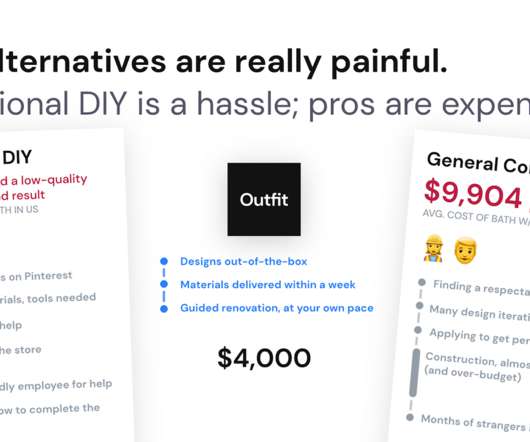

Investments & Improvements Myth #6: Major Renovations Guarantee a Return on Investment Home tastes and styles change. Some clients may even ask if they should look into a HELOC for renovations. Plus, consider the fact that if an issue arises during the inspection, they can offer a credit to keep the deal moving forward.

Let's personalize your content