How Fast Can You Get Pre-Approved for a Home Loan?

Redfin

JULY 9, 2025

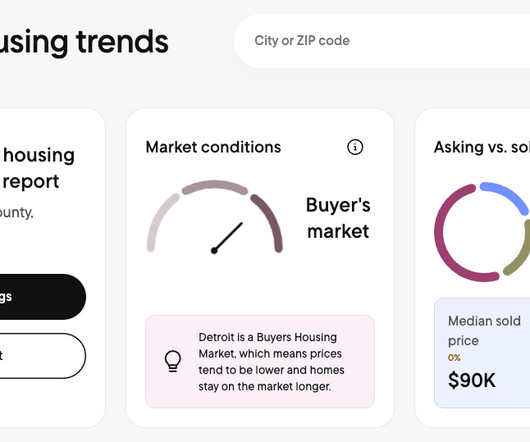

Getting pre-approved for a mortgage is one of the first steps in the homebuying journey. But if you’re ready to start shopping for a home, you might be wondering: how long does it take to get pre-approved for a mortgage? What is mortgage pre-approval? Why it matters: It helps you set a realistic budget.

Let's personalize your content