How the PLS market is making money on delinquent loans

Housing Wire

JUNE 3, 2022

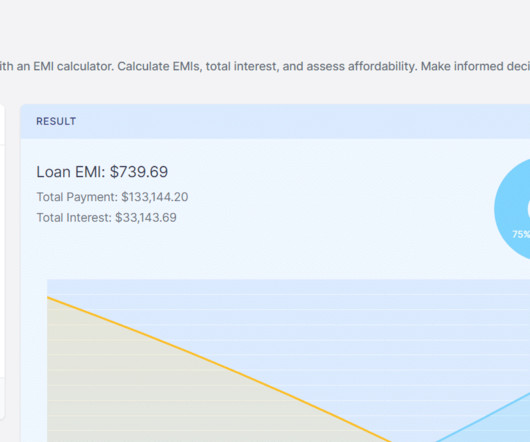

Lakeview Loan Servicing unveiled a rare private-label securities offering this past March involving a pool of mostly delinquent mortgages serviced by the company. The loans in the offering were all originated through the Federal Housing Administration (FHA) and later securitized through Ginnie Mae. In total, 99.3% In total, 99.3%

Let's personalize your content