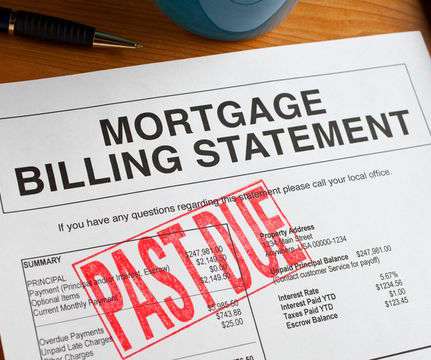

Despite moratoria, foreclosures increase 20% in October

Housing Wire

NOVEMBER 11, 2020

As for foreclosure filings – including default notices, scheduled auctions or bank repossessions – approximately 11,673 U.S It’s likely that many of these properties were already in the early stages of default prior to the pandemic, or are vacant and abandoned, which makes them candidates for expedited foreclosure actions.”.

Let's personalize your content