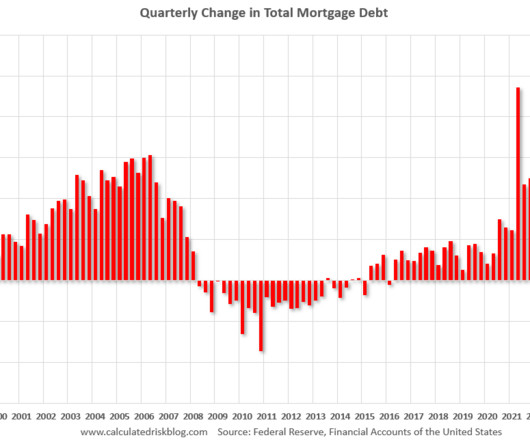

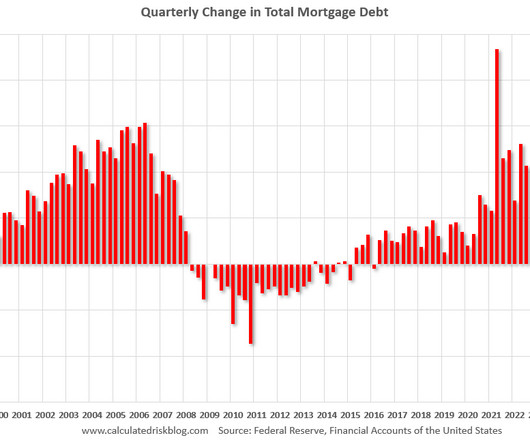

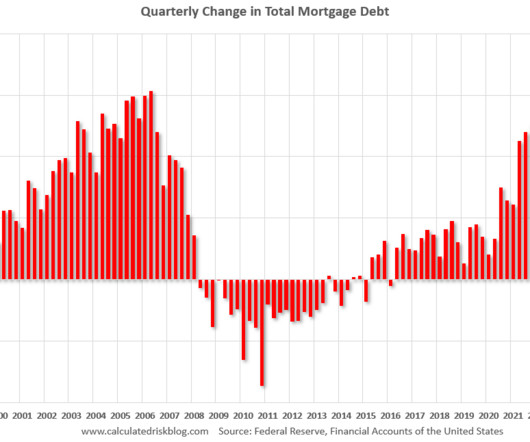

The "Home ATM" Stays Mostly Closed in Q2

Calculated Risk Real Estate

SEPTEMBER 8, 2023

During the housing bubble, many homeowners borrowed heavily against their perceived home equity - jokingly calling it the “Home ATM” - and this contributed to the subsequent housing bust, since so many homeowners had negative equity in their homes when house prices declined.

Let's personalize your content