Distressed properties signal a slowdown in 2025 housing market

Housing Wire

DECEMBER 12, 2024

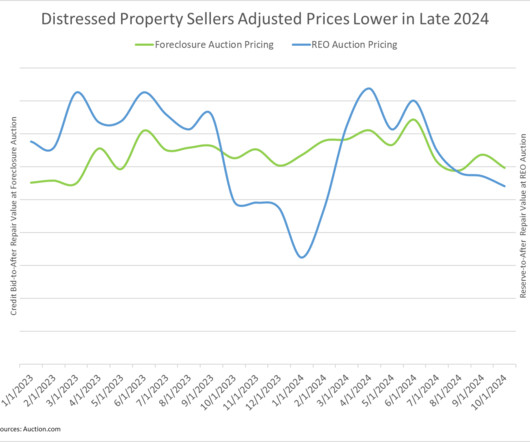

Proprietary data from the Auction.com marketplace, which accounts for close to half of all properties brought to foreclosure auction nationwide, shows that banks, nonbanks and mortgage servicers selling on the Auction.com platform have slowly lowered their pricing at both foreclosure auctions and bank-owned (REO) auctions over the past six months.

Let's personalize your content