Flagstar Bank makes changes to TPO leadership

Housing Wire

MAY 7, 2024

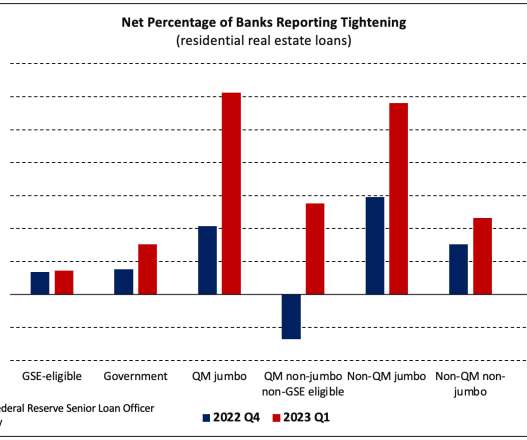

Flagstar Bank has made changes to its third-party origination (TPO) channel leadership. Hoffman has spent more than 30 years in mortgage banking, 22 of them at Flagstar, where he started as an account executive. According to Inside Mortgage Finance (IMF) estimates, Flagstar produced $14.2 lender in the space.

Let's personalize your content