Home equity cushions homeowners against economic shocks

Housing Wire

JUNE 30, 2025

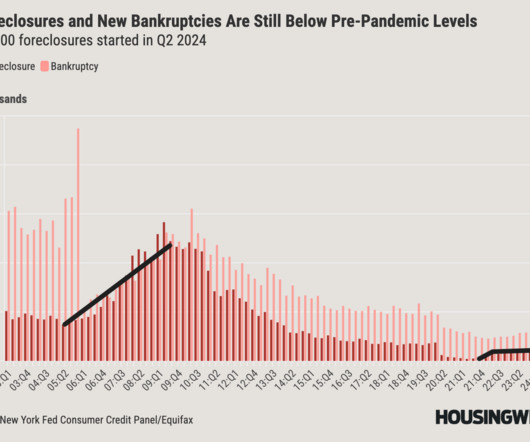

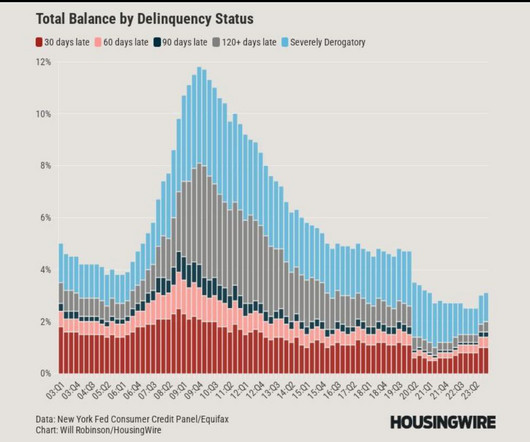

The most recent National Mortgage Database (NMDB) Aggregate Statistics report from FHFA reveals the significant amount of home equity that American households possess. Vast home equity cushion Keep this very simple: 82% of homeowners in America have at least 30% of equity in their homes.

Let's personalize your content