How are mortgage rates affecting housing demand?

Housing Wire

NOVEMBER 23, 2024

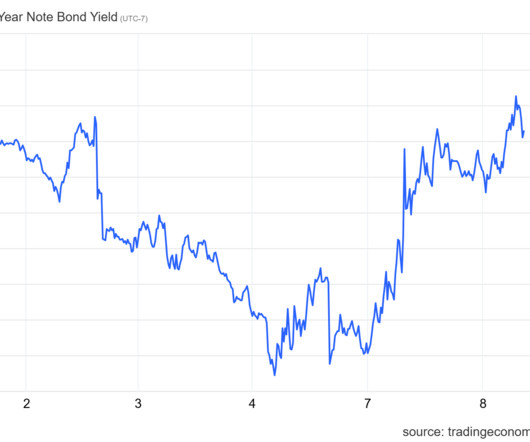

It has been almost two months since mortgage rates spiked again, and my initial thought was this would tank housing demand. We had a positive 18-week period with purchase applications before mortgage rates started rising in September. Initially, the data showed more robust performance as mortgage rates approached 6%.

Let's personalize your content