Smarter leads, lower costs: Agentic AI’s impact on loan officer efficiency

Housing Wire

MAY 9, 2025

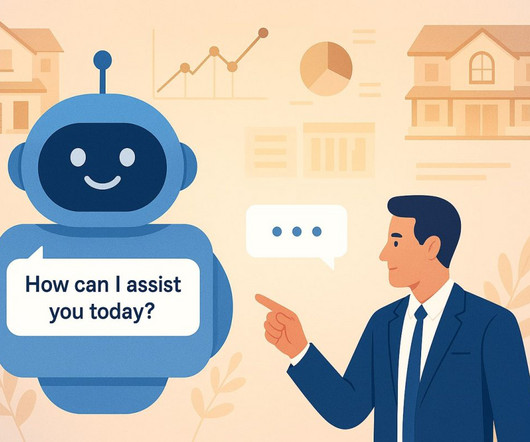

The expense associated with originating mortgage loans has been escalating, with the current average cost approximating $11,600 per loan. Agentic AI offers a compelling solution for reducing these costs. Agentic AI holds the promise of revolutionizing the existing digital approach.

Let's personalize your content